How to Offer Automated State Tax Nexus Checkers for U.S. Online Sellers

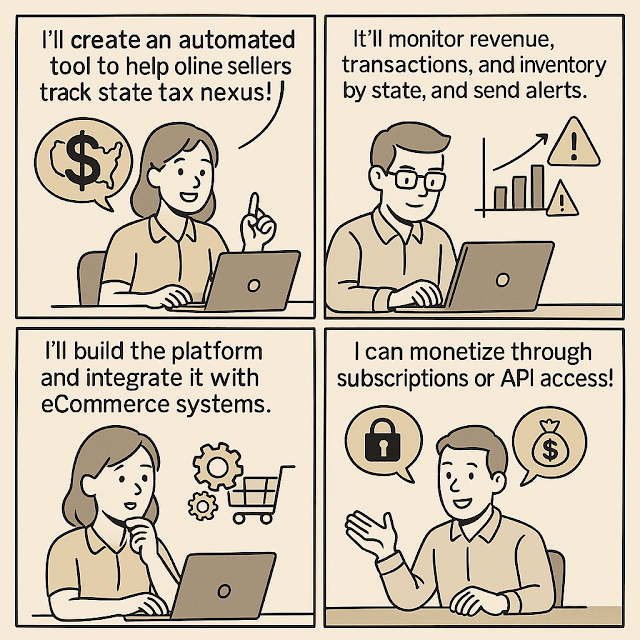

For U.S.-based eCommerce sellers, staying compliant with state tax obligations has become more complicated than ever.

With the rise of economic nexus laws post-Wayfair v. South Dakota, sellers need to monitor their presence in multiple states — and that’s where automated state tax nexus checkers come in.

This guide explains how you can build and monetize a solution that helps online sellers stay compliant across jurisdictions.

📌 Table of Contents

- What Is State Tax Nexus?

- Why Nexus Tracking Matters for Online Sellers

- How to Automate State Nexus Checks

- Building the Nexus Checker Platform

- Monetizing the Tool

- Ensuring Legal Compliance

- External Resources and Tools

📍 What Is State Tax Nexus?

Nexus is the connection between a business and a state that creates a tax obligation.

It can be triggered by physical presence (like a warehouse or office), or economic activity (like revenue or transaction thresholds).

After the Supreme Court ruling in Wayfair v. South Dakota (2018), most states adopted economic nexus standards.

⚠️ Why Nexus Tracking Matters for Online Sellers

Online sellers may unknowingly cross nexus thresholds in multiple states.

Failure to register, collect, and remit sales tax can lead to penalties, audits, and back taxes.

Manually tracking revenue and transactions by state is not scalable — hence the growing demand for automated solutions.

🤖 How to Automate State Nexus Checks

To build an automated nexus checker, your system should track:

- Gross revenue per state

- Number of transactions per state

- Inventory presence (for marketplace sellers)

Integrate your tool with eCommerce platforms (Shopify, WooCommerce, Amazon, etc.) via APIs to pull sales data.

Compare this data with each state’s thresholds (e.g., $100,000 or 200 transactions in many states).

Provide a real-time dashboard and alert system when a threshold is nearing or has been crossed.

🛠 Building the Nexus Checker Platform

Here’s a rough feature set for your MVP (Minimum Viable Product):

- User authentication

- Secure integration with sales channels

- State-by-state threshold database

- Real-time threshold comparison

- Alert notifications (email, SMS, dashboard)

For tech stack, you could use:

- Backend: Node.js or Python (Flask/FastAPI)

- Frontend: React or Vue

- Database: PostgreSQL (with JSON support for state rules)

- APIs: Use TaxJar or Avalara for real-time tax rate info

💰 Monetizing the Tool

Here are some business models to consider:

- SaaS Monthly Subscription: Tiered pricing based on sales volume or connected accounts

- Freemium: Free for one store, paid for multi-store tracking

- API Access: Charge devs/platforms for API calls

- Affiliate Revenue: Partner with tax filing software or accountants

Make sure your pricing reflects the value of avoiding expensive penalties and maintaining compliance.

🔐 Ensuring Legal Compliance

Your tool must have up-to-date tax nexus rules for all states — a task that requires constant data updates.

You may license this data from established providers like TaxJar or Avalara.

Also, provide a disclaimer: your tool provides guidance, not legal advice.

🔗 External Resources and Tools

For inspiration and additional insight, check out similar resources and educational platforms below:

Visit TreasInfo – Financial Insight HubExplore InfoGatherin – Tax & Commerce Guide

Learn from GatherInfor – Business Tools Explained

🎯 Final Thoughts

Automated state tax nexus checkers solve a real pain point for online sellers in the U.S.

By building a platform that monitors and alerts sellers of their multi-state obligations, you're offering peace of mind — and a highly marketable product.

Whether you're a developer, entrepreneur, or accountant, this space has immense potential.

Keywords: tax nexus checker, sales tax automation, economic nexus compliance, eCommerce tax tool, U.S. state tax SaaS